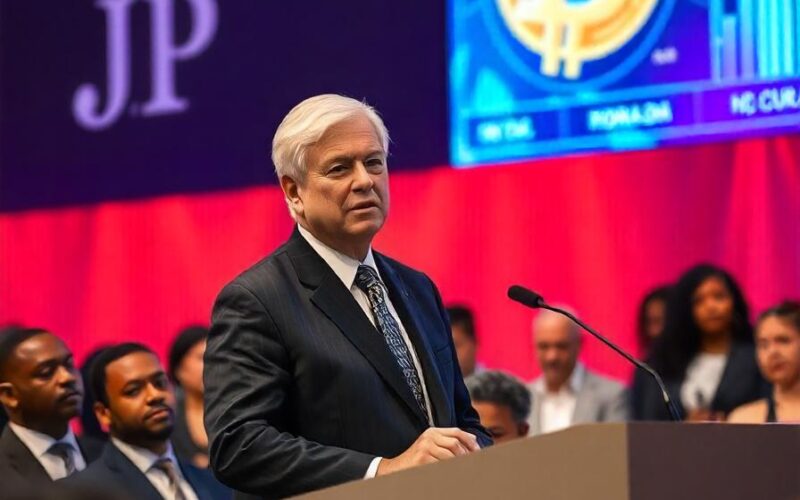

Jamie Dimon, the outspoken CEO of JPMorgan Chase, has renewed his criticism of Bitcoin, calling it a “decentralized Ponzi scheme” and claiming it lacks intrinsic value. Speaking during a recent event, Dimon reiterated his long-standing skepticism of the world’s largest cryptocurrency, citing its association with criminal activities like money laundering and ransomware attacks.

“Bitcoin itself has no intrinsic value,” Dimon stated, adding that while blockchain technology may hold promise, Bitcoin’s role in facilitating illicit activities undermines its legitimacy (Business Insider).

Dimon’s remarks echo his infamous declaration in 2017 when he labeled Bitcoin a “fraud” at a time when its price was around $63,000. Fast forward to today, Bitcoin’s value has soared to over $94,000, highlighting its enduring appeal despite Dimon’s warnings. Even as the cryptocurrency market matures, Dimon remains unconvinced of Bitcoin’s viability as a legitimate asset (The Wall Street Journal).

While Dimon continues to criticize Bitcoin, his stance on blockchain technology and digital assets is more nuanced. He has acknowledged the utility of stablecoins, which are pegged to traditional currencies, and emphasized JPMorgan’s efforts in blockchain innovation. The bank has launched its own blockchain-based services, including JPM Coin, to enhance transaction efficiency and meet client demand for digital solutions (Business Insider).

The irony of Dimon’s criticism lies in the broader trend within traditional finance, where institutions like JPMorgan are embracing blockchain and crypto-related technologies. Despite public skepticism from leaders like Dimon, firms are investing heavily in digital transformation to stay competitive.

Bitcoin’s price volatility and regulatory uncertainties remain central to the ongoing debate about its role in the global financial system. While Dimon’s critique resonates with skeptics, Bitcoin advocates argue that its decentralized nature and increasing adoption challenge the traditional financial framework.

As cryptocurrencies continue to evolve, the divide between traditional financial leaders and digital asset proponents underscores the complexity of integrating these innovations into mainstream finance. Dimon’s comments serve as a reminder of the deep-seated tensions within an industry undergoing rapid transformation (The Wall Street Journal).